Share Structure

TSX: EQX

NYSE American: EQX

Equinox Gold’s common shares are listed on the Toronto Stock Exchange and the NYSE American Exchange under the symbol “EQX”.

Share Structure

At June 17, 2025, Equinox Gold had the following securities issued and outstanding:

756.2 M

Common shares

30.0 M

Options, warrants and RSUs

52.9 M

Potential shares from convertible notes

839.1 M

Fully diluted shares*

*The fully diluted share count assumes full conversion of in-the-money convertible notes. The September 2025 note has a face value of $139.3 M and a conversion price of $6.50 per share. The October 2028 note has a face value of $172.5 M and a conversion price of $6.30 per share. The 2030 note has a face value of $35.0 M and a conversion price of C$12.14 per share.

TSX:EQX (C$)

NYSE-A:EQX (US$)

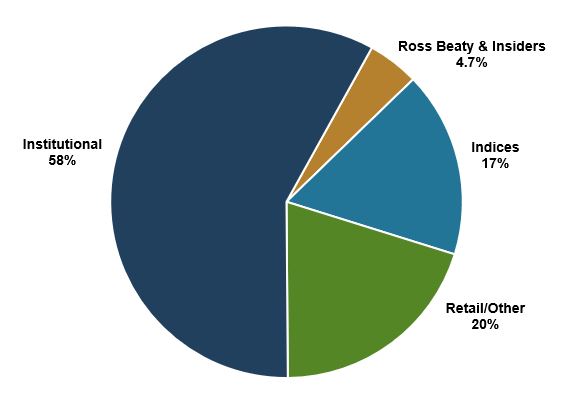

Top Shareholders

Based on the most recent reports on Form 13F filed by institutional investment managers, Equinox Gold’s top shareholders include:

- Van Eck & Associates

- Ross Beaty (individual shareholder and Chair)

- Orion Mine Finance

- Donald Smith & Co

- L1 Capital

- Invesco Advisers

- Fourth Sail Capital

- Sprott Asset Management

- Dimensional Fund Advisor

- Kopernik Global Investors

- Baker Steel Capital Managers

Responsible Mining

Operating with integrity

Responsible mining is our core focus and integral to the success of our business strategy.

Learn More